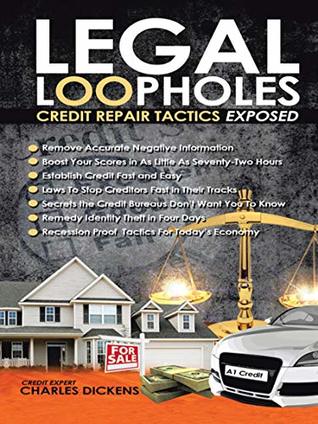

Read Legal Loopholes: Credit Repair Tactics Exposed - Charles Dickens | ePub

Related searches:

Credit repair is a process that allows you to fix or improve your credit. Fixing your credit could involve disputing incorrect information on your credit history and paying your credit card and loan bills on time.

If your credit is bad, credit repair is one option to consider. Whether you hire a credit repair company or go it alone, it's smart to make moves to improve your credit. If your credit is bad, credit repair is one option to consider.

I applied these legal-loopholes tactics and improved my credit score by over 100 points in less than 30 days! the author uses his legal background to shed light on the little-known provisions in the law, allowing you to legally and quickly repair your credit and boost your scores.

Legal loopholes: credit repair tactics exposed - kindle edition by dickens, charles. Download it once and read it on your kindle device, pc, phones or tablets. Use features like bookmarks, note taking and highlighting while reading legal loopholes: credit repair tactics exposed.

Legal loopholes: credit repair tactics exposed - ebook written by charles dickens. Read this book using google play books app on your pc, android, ios devices. Download for offline reading, highlight, bookmark or take notes while you read legal loopholes: credit repair tactics exposed.

Compre online legal loopholes: credit repair tactics exposed, de dickens, charles na amazon.

Don't pay credit repair companies thousands of dollars; do it yourself, and be fast on your way to owning the car or house of your dreams. • remove accurate negative information • boost your scores in as little as 72 hours • establish credit fast and easy • laws to stop creditors fast in their tracks.

Credit repair can be very easy when you employ all the tricks and secrets of credit the real way to improve your credit score is understanding the laws. Actual violations of your rights, not depending on luck, loopholes and generi.

Legal loopholes� credit repair tactics esposed by charles dickens (2013, trade paperback) the lowest-priced brand-new, unused, unopened, undamaged item in its original packaging (where packaging is applicable).

It helps you do things like purchase a new car or put a down payment on a house. If your credit score is below average, learn how to repair credit in six months or less with these helpful tips.

To know� remedy identity theft in 4 days�finally, a credit repair guide that delivers! i applied these legal-loopholes tactics and improved my credit score by over.

Clean up your credit, create a budget, and avoid overspending with this bestseller. You'll get sample credit reports, text of credit reporting laws, and more.

Before you begin do-it-yourself credit repair, you’ll want to get copies of your full credit reports from all three bureaus (experian, transunion, and equifax).

Compre legal loopholes: credit repair tactics exposed (english edition) de dickens, charles na amazon.

Here are some key facts about credit repair that will help you achieve better scores. It's difficult to navigate today's society with a bad credit.

The easy section 609 credit repair secret: remove all negative accounts in 30 days using a federal law loophole that works every time - kindle edition by weaver, brandon. Download it once and read it on your kindle device, pc, phones or tablets.

K legal loopholes:credit repair tactics esposed by by by charles dickens it is estimated that over 80 million americans are living with poor credit, and recent studies have.

March 26, 2014— -- if you want to use credit or get a loan someday, you should work on raising your credit score. It can take a while to earn a good credit standing, and for the most part, that.

You can buy positive credit history from others, but it may not be safe. Many credit scoring algorithms now discount authorized users accounts.

Legal loopholes: credit repair tactics exposed: dickens, charles: amazon.

Many states also have laws regulating credit repair companies. If you have a problem with a credit repair company, report it to your local consumer affairs office or to your state attorney general (ag). You also can file a complaint with the federal trade commission.

Post Your Comments: